In the realm of global finance, the movement of currencies holds a significant impact on the economic landscape and investor sentiment. The USD, being the world’s primary reserve currency, often serves as a barometer for market trends and volatility. Recent speculations and analyses suggest that the USD may be gearing up for a substantial rally in the near future, which could have far-reaching implications for various markets and stakeholders.

The USD has been through a period of relative weakness in recent months, influenced by a myriad of factors such as the economic impact of the ongoing Covid-19 pandemic, global trade tensions, and internal political uncertainties. As a result, the USD index, which measures the value of the dollar against a basket of major currencies, has shown signs of fluctuation and weakness.

However, a closer look at the current market dynamics and emerging trends indicates that the USD may be in the early stages of a turnaround. Several key factors are contributing to this potential reversal, one of which is the growing economic divergence between the United States and other major economies. As the US economy shows signs of resilience and recovery, supported by robust employment figures and strong fiscal stimulus measures, investors are starting to gravitate towards dollar-denominated assets as a safe haven.

Furthermore, the Federal Reserve’s monetary policy stance and interest rate trajectory play a crucial role in shaping the USD’s prospects. The recent hints of a possible tapering of asset purchases and a gradual normalization of interest rates by the Federal Reserve have bolstered market expectations of a stronger dollar in the medium to long term.

Geopolitical developments and global risk sentiment also factor into the USD’s potential rally. Escalating tensions between major powers, uncertainties surrounding Brexit, and geopolitical flashpoints in different regions could prompt investors to seek refuge in the USD, further supporting its uptrend.

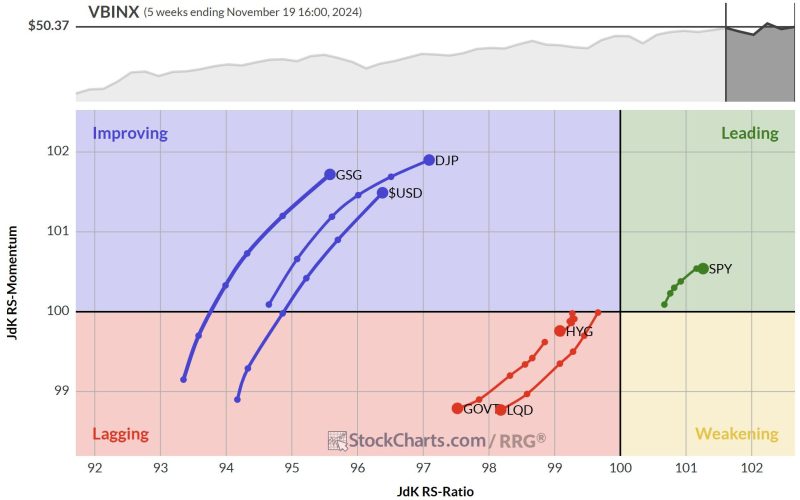

Additionally, technical analysis of the USD index charts reveals interesting patterns and levels that suggest a possible bullish breakout in the coming months. Traders and analysts are closely monitoring key resistance and support levels to gauge the USD’s momentum and direction.

It is essential to note that market dynamics are dynamic and subject to rapid changes, influenced by a wide array of variables. While the outlook for the USD appears optimistic at present, unforeseen events or shifts in economic fundamentals could alter the currency’s trajectory. Investors and market participants are advised to exercise caution, conduct thorough research, and stay abreast of developments to navigate the evolving landscape effectively.

In conclusion, the USD’s potential rally presents both opportunities and risks for investors and market participants. By understanding the underlying factors shaping the currency’s movement and staying informed about global economic trends, stakeholders can position themselves strategically to navigate the unfolding scenario successfully. As the USD embarks on a possible path to recovery and strength, it remains to be seen how this journey will impact the broader financial landscape and international markets.