Decoding the Semiconductor ETF Battle: SMH vs. SOXX – Unveiling the Resilience of SMH!

In the fast-evolving world of technology, the semiconductor industry plays a crucial role in powering various electronic devices, making advancements in artificial intelligence, cloud computing, and the Internet of Things possible. As investors seek opportunities to capitalize on the growth of this sector, exchange-traded funds (ETFs) focused on semiconductor companies have garnered significant attention. Two popular ETFs that give investors exposure to semiconductor stocks are the VanEck Vectors Semiconductor ETF (SMH) and the iShares PHLX Semiconductor ETF (SOXX). Despite tracking similar segments of the market, these two ETFs have exhibited varying performance trends in recent times.

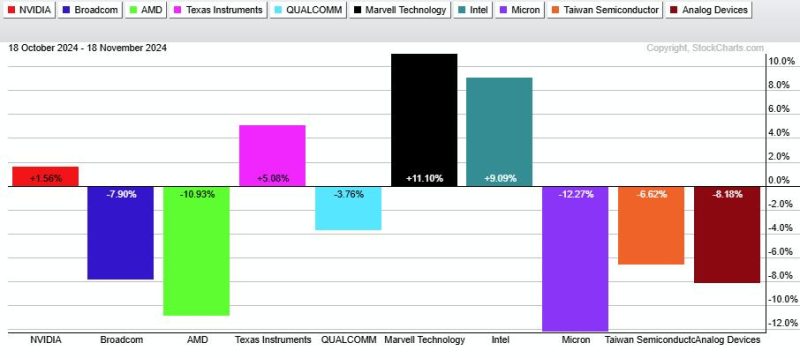

The technology sector has faced numerous challenges, including supply chain disruptions, global economic uncertainties, and geopolitical tensions. These factors have significantly impacted semiconductor companies and their stocks, leading to fluctuations in the performance of semiconductor ETFs like SMH and SOXX. Despite these challenges, SMH has managed to hold up better than SOXX due to several key factors.

One of the primary reasons for SMH’s relatively stronger performance is its diversified portfolio of semiconductor stocks. This ETF tracks the MVIS US Listed Semiconductor 25 Index, which includes 25 of the largest U.S.-listed companies involved in the semiconductor industry. By investing in a broader range of semiconductor companies, SMH is better positioned to weather market volatility and potential downturns in specific segments of the industry.

In contrast, SOXX tracks the PHLX Semiconductor Sector Index, which consists of a smaller number of semiconductor companies. This concentrated exposure can make SOXX more susceptible to fluctuations in the performance of individual stocks or subsectors within the semiconductor industry. As a result, SOXX may exhibit more pronounced volatility compared to SMH, especially during periods of market uncertainty.

Another factor contributing to SMH’s resilience is its focus on established semiconductor companies with a proven track record of innovation and market leadership. These companies often have strong balance sheets, diversified revenue streams, and advanced technologies that enable them to adapt to changing market conditions and sustain long-term growth. By investing in such companies, SMH benefits from greater stability and growth potential, which can help cushion its performance during challenging market environments.

On the other hand, SOXX may include a higher proportion of smaller or more speculative companies that are still in the early stages of growth and development. While these companies may offer greater upside potential, they also carry higher risks and may be more susceptible to market fluctuations and competitive pressures. As a result, SOXX’s performance may be more volatile compared to SMH, as it is influenced by the success or failure of these emerging semiconductor players.

In conclusion, the performance of semiconductor ETFs like SMH and SOXX is influenced by a variety of factors, including portfolio composition, company exposure, and market dynamics. While both ETFs offer investors an opportunity to participate in the growth of the semiconductor industry, SMH’s diversified portfolio and focus on established industry leaders have contributed to its relatively stronger performance compared to SOXX. As the semiconductor sector continues to evolve, investors should carefully evaluate their investment objectives and risk tolerance when considering exposure to semiconductor ETFs to align with their financial goals and objectives.