Investing in Chromium Stocks: A Lucrative Opportunity for 2024

Understanding the Chromium Market

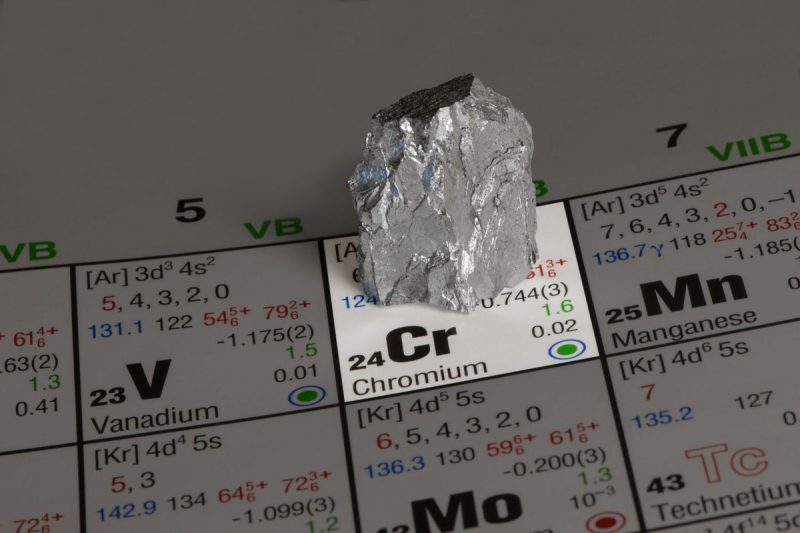

Chromium is a versatile and valuable metal widely used in various industries, including stainless steel production, aerospace, and automotive sectors. Its excellent corrosion resistance and high melting point make it a crucial component in many industrial applications. With the increasing demand for stainless steel products globally, the chromium market is expected to grow steadily in the coming years.

Factors to Consider Before Investing in Chromium Stocks

Before venturing into investing in chromium stocks, there are several crucial factors to consider to make informed decisions and maximize your returns. Here are some essential considerations:

1. Global Chromium Demand: Analyzing the global demand trends for chromium is essential to understand the market dynamics. Factors such as industrial growth, infrastructure development, and technological advancements can impact the demand for chromium products.

2. Supply Chain Factors: Understanding the chromium supply chain, including mining operations, processing facilities, and transportation logistics, is crucial. Any disruptions in the supply chain can significantly impact the market prices and profitability of chromium stocks.

3. Price Volatility: Chromium prices are subject to fluctuations due to various factors such as supply-demand imbalances, geopolitical events, and currency exchange rates. Investors should be prepared to navigate the volatility in the market and develop risk management strategies.

4. Environmental Regulations: Environmental regulations play a significant role in the chromium industry, particularly in mining and processing operations. Companies that adhere to stringent environmental standards are more likely to sustain long-term growth and profitability.

Best Practices for Investing in Chromium Stocks

To make informed investment decisions in chromium stocks, consider the following best practices:

1. Conduct Thorough Research: Before investing in any chromium stock, conduct thorough research on the company’s financial health, market position, growth prospects, and competitive landscape. Look for companies with a solid track record of performance and a strong growth potential.

2. Diversify Your Portfolio: Diversification is key to managing risk in your investment portfolio. Consider investing in a mix of chromium stocks across different companies and regions to spread your risk and maximize potential returns.

3. Monitor Market Trends: Stay informed about the latest market trends, industry developments, and global economic conditions that can impact chromium prices and stock performance. Regularly monitor financial news and industry reports to make timely investment decisions.

4. Seek Professional Advice: If you are new to investing or uncertain about the chromium market, consider seeking advice from financial advisors or investment professionals with expertise in commodities and metals. Their insights can help you navigate the complexities of the market and make informed decisions.

In conclusion, investing in chromium stocks can be a lucrative opportunity for investors looking to diversify their portfolios and capitalize on the growing demand for industrial metals. By understanding the market dynamics, conducting thorough research, and following best practices, investors can position themselves for success in the chromium market in 2024 and beyond.