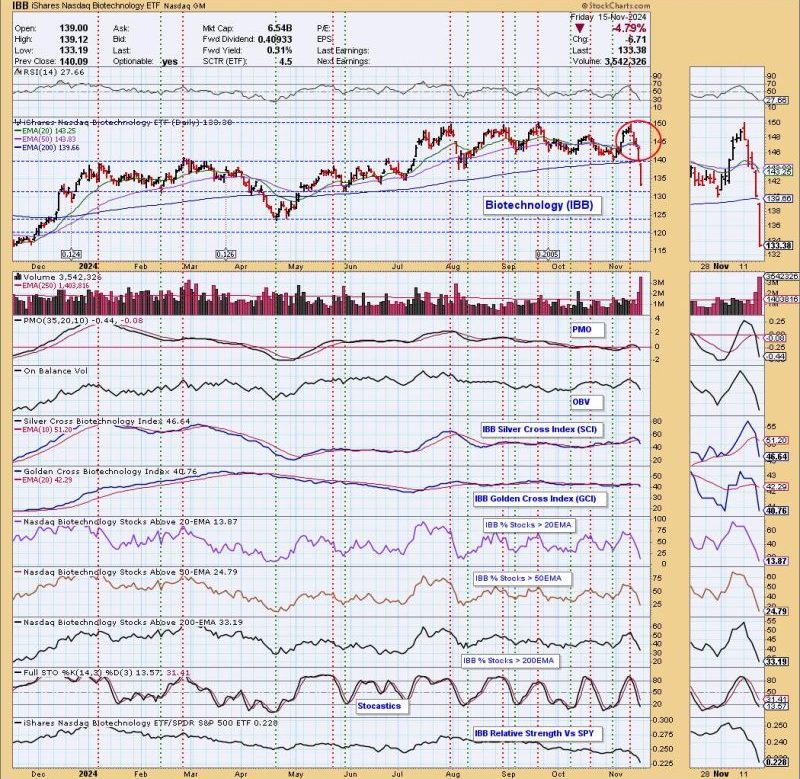

The article unravels the potential downfall of biotech stocks as signaled by the dark cross neutral pattern. This bearish indication poses serious concerns for investors who have dived into the sector hoping for lucrative returns. Given the intricate relationship between market patterns and stock performances, understanding the implications of the dark cross neutral signal becomes imperative for prudent decision-making.

Biotech stocks have long been seen as a high-risk, high-reward investment opportunity due to their involvement in developing cutting-edge medical advancements and treatments. However, as the article suggests, the sector is currently at a crossroads, with the dark cross neutral signal casting a shadow over its future prospects. This pattern, characterized by the 50-day moving average crossing below the 200-day moving average, usually portends a bearish trend ahead.

Investors in biotech companies need to heed this warning signal and reassess their investment strategies accordingly. While past performance is not always indicative of future results, technical indicators like the dark cross can provide valuable insights into the market sentiment and potential trajectory of stock prices. It’s crucial for investors to remain vigilant and stay informed about such signals to avoid significant losses.

Moreover, the article emphasizes the importance of diversifying one’s investment portfolio to mitigate risks associated with any single sector. By spreading out investments across different industries and asset classes, investors can better withstand market fluctuations and reduce their exposure to sector-specific downturns, such as the one looming over biotechs.

In conclusion, while the dark cross neutral signal may spell trouble for biotech stocks in the near term, diligent investors can still navigate this challenging terrain by staying informed, diversifying their portfolios, and seeking professional financial advice when needed. By adopting a cautious and strategic approach, investors can weather the storm and potentially emerge stronger in the long run, even amidst uncertain market conditions.