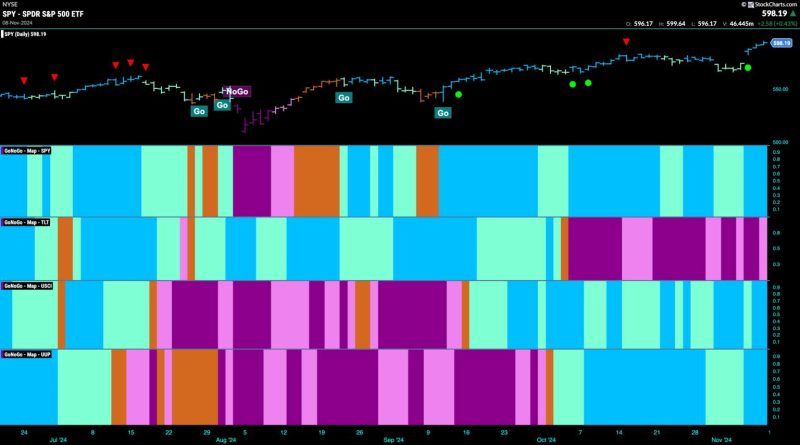

Riding the Momentum: Equity Go Trend Powers Up as Financials Lift Prices

EquityGo Trend Sees Surge in Strength as Financials Drive Price Higher

The equity market has been buzzing with activity lately, as the EquityGo trend continues to see a surge in strength. This upward trajectory can largely be attributed to the performance of financial sector stocks, which have been driving prices higher and attracting investor interest.

Financials have been a standout sector within the EquityGo trend, with banks, insurance companies, and other financial institutions leading the charge. This surge in strength has been fueled by positive earnings reports, improved economic indicators, and overall market optimism.

One key factor contributing to the strength of financials in the EquityGo trend is the Federal Reserve’s interest rate policy. The central bank’s decision to cut interest rates has been a boon for financial companies, as lower rates make borrowing cheaper and stimulate economic growth. This has translated into higher stock prices for financials, as investors anticipate increased profitability in the sector.

In addition to the interest rate environment, strong corporate earnings have also played a significant role in driving the EquityGo trend higher. Many financial companies have reported better-than-expected earnings for the recent quarter, signaling that the sector is in good health and poised for growth.

Another contributing factor to the strength of financials in the EquityGo trend is the overall positive sentiment in the market. With trade tensions easing, economic indicators improving, and global growth prospects looking brighter, investors are feeling more confident about the future, leading to increased investment in financial stocks.

As the EquityGo trend continues to gain momentum, investors are closely watching the financial sector for further opportunities. With positive earnings, favorable interest rate policies, and a bullish market outlook, financial stocks are likely to remain a key driver of the EquityGo trend in the coming months.