Riding the Wave: Secular Bull Market Powers On with Major Rotation

Secular Bull Market Continues but with Major Rotation

As the global financial markets navigate through the post-pandemic landscape, the secular bull market that began in 2009 appears to be continuing its upward trajectory, but not without significant rotations and reshuffling of economic sectors. This period of transition is marked by considerable shifts in investor sentiment, industry leadership, and market dynamics.

One of the key indicators of the ongoing secular bull market is the sustained upward movement of major stock indices, such as the S&P 500 and Nasdaq Composite, reaching new all-time highs despite intermittent bouts of volatility. This resilience can be attributed to the combination of widespread vaccination efforts, unprecedented fiscal stimulus, and accommodative monetary policies that have supported economic recovery and bolstered investor confidence.

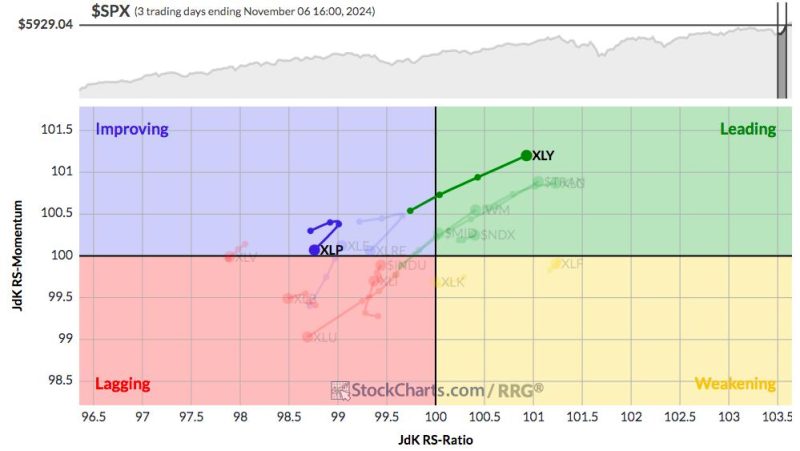

However, beneath the surface of this broad market rally lies a notable shift in sectoral leadership that is reshaping the investment landscape. The technology sector, which has been a primary driver of market gains in recent years, is now facing increased scrutiny from investors concerned about lofty valuations and regulatory headwinds. As a result, there has been a discernible rotation away from high-growth tech stocks towards more cyclical and value-oriented sectors, such as energy, financials, industrials, and materials.

This rotation is emblematic of the broader transition towards a more balanced and diversified investment strategy, as investors seek opportunities beyond the traditional growth darlings that have dominated the market in the past decade. Companies that stand to benefit from the reopening of the global economy, such as those in the travel, leisure, and hospitality sectors, are attracting keen interest from investors looking to capitalize on the recovery trade.

Moreover, the resurgence of inflationary pressures and rising interest rates have further fueled the rotation towards cyclical and value stocks, as these sectors tend to outperform in environments characterized by accelerating economic growth and higher inflation expectations. This cyclical tilt reflects a shift towards a more inflation-conscious investment approach, as market participants recalibrate their portfolios to hedge against potential risks stemming from a sustained rise in prices.

Despite the evolving market dynamics and changing sectoral preferences, the fundamental underpinnings of the secular bull market remain intact, supported by favorable macroeconomic conditions, robust corporate earnings, and the prospect of continued economic expansion. While periodic market corrections and sector rotations are inevitable, they often present opportunities for astute investors to realign their portfolios and position themselves for long-term growth.

In conclusion, the secular bull market continues to advance, albeit with major rotations and shifts in sectoral leadership. The ongoing transition towards a more balanced and diversified investment strategy underscores the importance of adaptability and agility in navigating the complexities of the current market environment. By staying informed, disciplined, and proactive, investors can successfully navigate the twists and turns of the market cycle and position themselves for sustained success in this ever-evolving landscape.