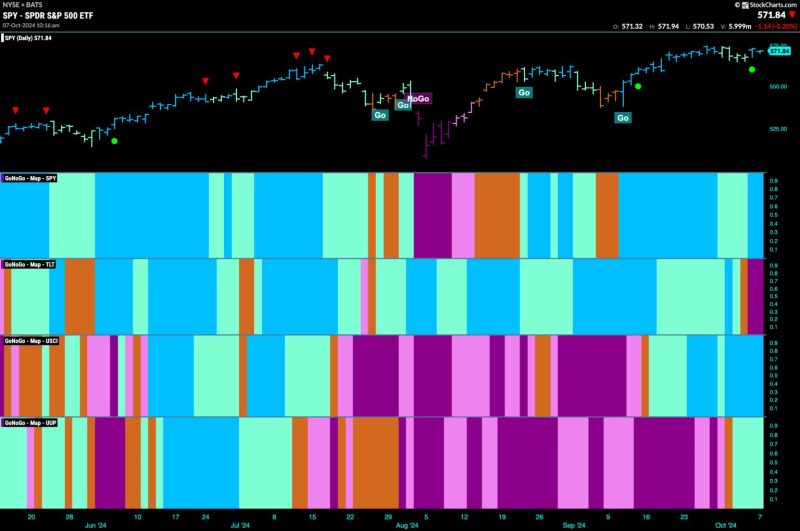

Equities Remain in Go Trend and Lean into Energy

Key Market Indicators

Equities have continued to show strength and resilience, with major stock indices hitting record highs in recent trading sessions. The Go Trend, which emphasizes momentum and growth, remains dominant in the current market environment. Investors continue to express confidence in the overall economic outlook, driving stock prices higher.

One sector that has particularly stood out in recent weeks is the energy sector. Energy stocks have experienced a notable resurgence, outperforming other sectors and attracting significant investor interest. The surge in energy prices, driven by factors such as geopolitical tensions and supply disruptions, has fueled the rally in energy stocks.

Analysts point to the potential for sustained growth in the energy sector, supported by favorable market conditions and strong demand for energy products. The transition toward cleaner energy sources and the increasing global focus on sustainability have also contributed to the positive sentiment surrounding energy stocks.

Industry Impact

The strong performance of energy stocks has had a ripple effect across related industries and sectors. Companies involved in oil production, exploration, and refining have seen their stock prices soar, benefiting from the overall bullish sentiment toward energy stocks.

Additionally, sectors such as industrials and materials have also experienced a boost, as these industries are closely linked to the energy sector through supply chains and demand dynamics. The positive momentum in energy stocks has provided a tailwind for companies across various sectors, driving broader market gains.

Investor Strategies

Given the current market environment and the strong performance of equities, investors are exploring different strategies to capitalize on the opportunities presented. Many investors are leaning into the energy sector, allocating a larger portion of their portfolios to energy stocks in anticipation of further upside potential.

Others are adopting a diversified approach, spreading their investments across multiple sectors to mitigate risk and capture opportunities in different parts of the market. With market conditions evolving rapidly, flexibility and adaptability are key attributes for investors seeking to navigate the dynamic landscape of equities.

Looking Ahead

As equities continue to exhibit strength and resilience, investors will be closely monitoring market developments and adjusting their strategies accordingly. The Go Trend remains a dominant force in driving stock prices higher, with energy stocks emerging as a key focal point of investor interest.

Amid ongoing volatility and uncertainty, staying informed and agile in responding to market opportunities will be crucial for investors seeking to capitalize on the current bullish momentum. By leveraging insights from industry experts and monitoring key market indicators, investors can position themselves strategically to achieve their financial goals in a dynamic and ever-changing market environment.