Navigating the Week Ahead: Gain Insight on Market Trends and Keep an Eye on Nifty’s Progress

In today’s financial landscape, investors are constantly seeking out insights and analysis to help navigate the complexities of the market. The rise of online platforms and real-time information has provided traders with an abundance of data, but the challenge lies in interpreting this data to make informed decisions. One such key market indicator that traders often keep a close eye on is the Nifty index, renowned for its significance in the Indian stock market.

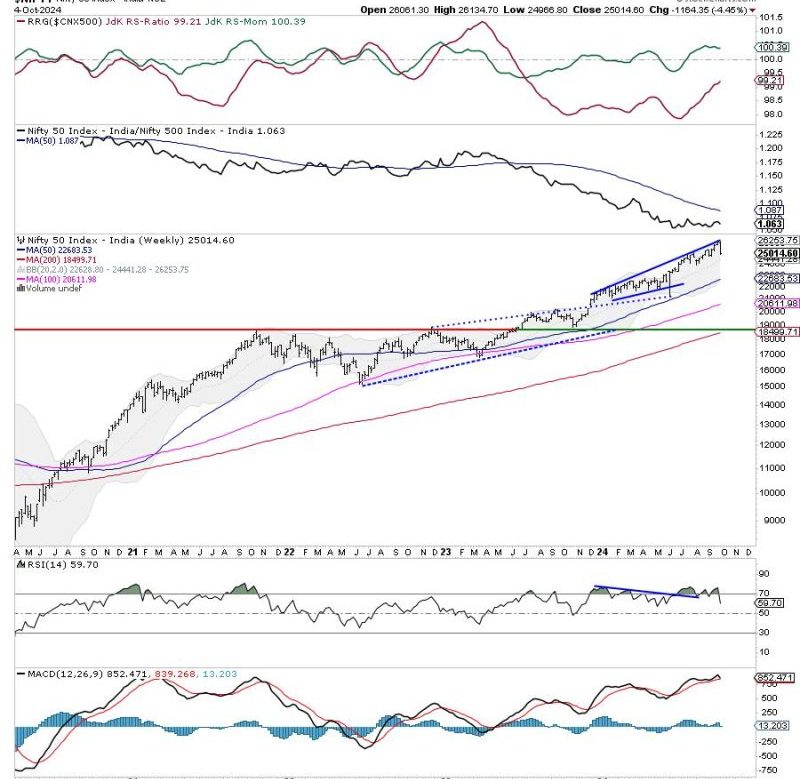

The Nifty index, formally known as the Nifty 50, represents the performance of the top 50 companies listed on the National Stock Exchange of India (NSE). As a benchmark index, it serves as a gauge of the overall market sentiment and provides vital information regarding market movements. Traders and investors track the Nifty index closely to anticipate trends and identify potential opportunities for profitable trades.

Analyzing the Nifty index from various angles allows traders to gain deeper insights into market dynamics and make more informed trading decisions. Technical analysis, a popular approach used by traders, involves studying historical price movements and chart patterns to forecast future price levels. By applying technical indicators and chart patterns to the Nifty index, traders can identify potential entry and exit points to optimize their trading strategies.

In addition to technical analysis, fundamental factors play a crucial role in influencing the movements of the Nifty index. Economic indicators, corporate earnings, government policies, and global events all impact market sentiment and can drive the Nifty index in different directions. By staying abreast of relevant news and developments, traders can better understand the underlying factors driving market movements and adjust their strategies accordingly.

Market sentiment and investor psychology also influence the behavior of the Nifty index. Fear, greed, optimism, and pessimism are all emotions that can drive market participants to buy or sell, leading to fluctuations in the index. Understanding market sentiment and recognizing potential shifts in investor psychology can help traders anticipate market movements and position themselves strategically in the market.

Risk management is another critical aspect that traders must consider when trading the Nifty index. Implementing stop-loss orders, setting profit targets, and managing position sizes are all essential risk management techniques that can help traders protect their capital and minimize potential losses. By adhering to sound risk management principles, traders can navigate market volatility and preserve their trading capital over the long term.

In conclusion, the Nifty index serves as a valuable tool for traders to gauge market sentiment, identify trends, and make informed trading decisions. By analyzing the Nifty index from multiple perspectives, incorporating technical and fundamental analysis, and considering market sentiment and risk management principles, traders can enhance their trading strategies and improve their chances of success in the dynamic world of the stock market.