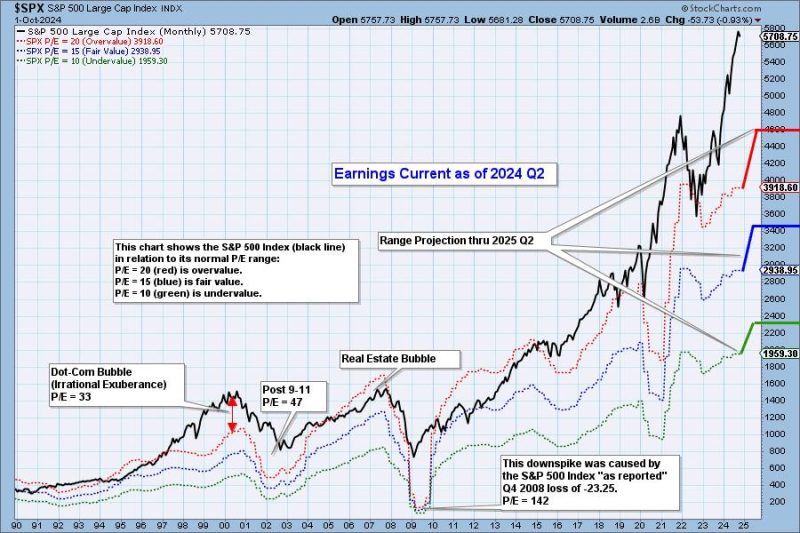

With the release of the Q2 earnings for 2024, the stock market appears to be teetering on the edge of extreme overvaluation. Investors and analysts are closely watching this development, uncertain about the potential implications it may have on the larger economic landscape.

One of the key indicators of overvaluation in the market is the continuous rise in stock prices despite stagnant or declining earnings. A disconnect between stock valuations and underlying corporate performance raises concerns about the sustainability of current market levels. In the absence of strong fundamental support, the risk of a market correction looms large.

Moreover, the prevailing exuberance among investors, driven in part by easy monetary policies and low interest rates, has pushed stock prices to unprecedented levels. While this has fueled rapid wealth creation for some, it has also fueled fears of a bubble that may eventually burst, causing widespread damage to portfolios and the broader economy.

Another factor contributing to the market’s overvaluation is the influx of retail investors, many of whom are new to investing and may not fully grasp the risks involved. Social media platforms and commission-free trading apps have democratized access to the stock market, but they have also fostered a speculative environment where the herd mentality can drive prices far beyond reasonable levels.

Consequently, seasoned investors and market analysts are sounding the alarm, urging caution and prudent risk management in the face of the market’s frothy valuations. Diversification, disciplined investing, and a focus on long-term value creation are becoming increasingly important strategies in a market environment that seems poised for a reckoning.

In conclusion, the Q2 earnings report for 2024 has cast a spotlight on the growing concerns surrounding the overvaluation of the market. While the exact timing and nature of a potential market correction remain uncertain, investors would be wise to tread carefully, remain vigilant, and be prepared to weather potential storms ahead.