Rate Cuts and Stock Performance: Unveiling the Bull vs. Bear Debate

Beneath the Surface: Analyzing the Impact of Rate Cuts on Stock Performance

Understanding the relationship between interest rate cuts and stock performance is essential for investors navigating volatile markets. The debate between being bullish or bearish following rate cuts is perennial, with proponents on both sides presenting persuasive arguments. However, beneath the surface lies a more nuanced narrative that goes beyond simple cause-and-effect relationships.

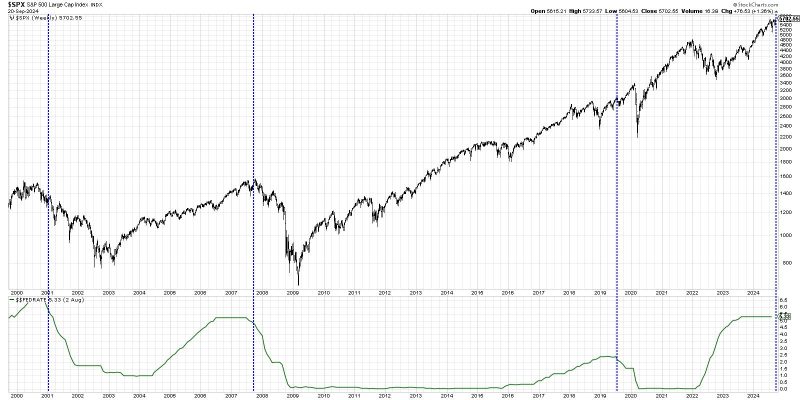

Historically, the Federal Reserve has employed interest rate cuts as a tool to stimulate economic growth during periods of stagnation or recession. Lower interest rates can lead to increased consumer spending, corporate borrowing, and investment in the market, all of which are positives for stock performance. On the surface, this would suggest a bullish outlook for stocks following rate cuts.

However, the reality is often more complex. Market reactions to rate cuts can vary based on a multitude of factors, including the current state of the economy, market sentiment, and external influences. For instance, if rate cuts are perceived as a response to a looming economic downturn, investors may interpret them as a signal of underlying weakness in the economy, leading to a bearish sentiment despite the stimulus provided by lower rates.

Moreover, the impact of rate cuts on different sectors of the market can diverge significantly. While rate cuts may benefit sectors that are sensitive to interest rates, such as housing and construction, they can have adverse effects on sectors like banking, which rely on a healthy interest rate environment to generate profits.

Additionally, the timing and magnitude of rate cuts play a crucial role in determining their overall impact on stock performance. Rapid and aggressive rate cuts by central banks can be interpreted as a sign of urgency and potentially escalate concerns about the state of the economy, triggering a bearish response from investors.

Furthermore, global interconnectedness and cross-market correlations mean that the effects of rate cuts in one country can spill over to others, creating a ripple effect that reverberates across international markets. In a globally integrated financial system, investors must consider not only domestic rate cuts but also their repercussions on foreign markets.

In conclusion, the relationship between rate cuts and stock performance is far from straightforward, with multiple variables at play that can influence market dynamics in unpredictable ways. While rate cuts can provide a boost to the economy and stimulate stock prices, investors must delve beneath the surface to understand the broader context and implications of such monetary policy decisions. By adopting a nuanced approach and considering a range of factors, investors can navigate the complexities of rate cuts and position themselves strategically in an ever-evolving market landscape.