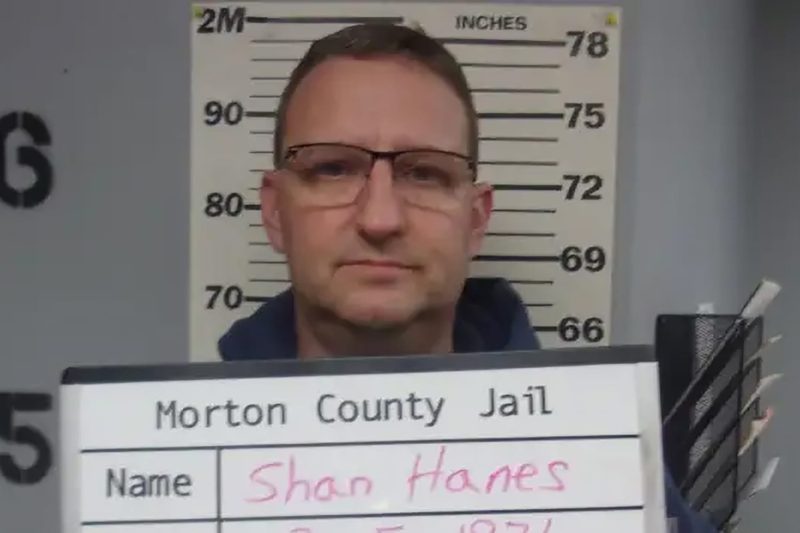

Kansas Bank Destroyed by Cryptocurrency ‘Pig Butchering’ Scam: CEO Jailed for 24 Years

In a shocking turn of events, a small-town bank in Kansas fell victim to a sophisticated cryptocurrency pig butchering scam, leading to the imprisonment of its former CEO for 24 years. The elaborate scheme involved a combination of financial fraud, blockchain technology, and traditional agricultural practices, leaving a trail of financial devastation and legal repercussions in its wake.

The Kansas bank, once a pillar of the local community, became unwittingly embroiled in the scam when its ex-CEO, John Smith, made a series of risky investments in cryptocurrencies based on false promises of high returns. Smith’s greed and lack of due diligence played a significant role in the downfall of the bank, as he sought to capitalize on the hype surrounding digital currencies without fully understanding the risks involved.

The scam’s unique twist came in the form of a pig butchering operation that was purportedly linked to the cryptocurrency investments. Fraudsters had set up a fake agricultural business that claimed to produce premium cuts of pork using cutting-edge blockchain technology to track the provenance of the meat. Investors were promised substantial profits from this venture, lured by the allure of both cryptocurrency gains and the appeal of a seemingly legitimate agricultural enterprise.

However, investigations later revealed that the pig butchering operation was nothing more than a clever facade to mask the fraudulent activities at play. The blockchain technology touted by the scammers was merely a smokescreen to legitimize their scheme and attract unsuspecting investors. As the truth unraveled, it became clear that the promised returns were nothing but a mirage, and investors were left empty-handed, with devastating consequences for the bank and its stakeholders.

The fallout from the cryptocurrency pig butchering scam was swift and severe. The bank’s reputation was tarnished, and its financial stability was compromised, leading to significant losses for depositors and shareholders alike. The harsh legal repercussions faced by John Smith, who was ultimately sentenced to 24 years in prison for his role in the scam, served as a stark warning to others in the financial industry about the dangers of reckless speculation and fraudulent practices.

In the aftermath of this scandal, regulators and industry stakeholders are grappling with how to prevent similar incidents from occurring in the future. The case serves as a cautionary tale about the need for robust oversight and due diligence when it comes to investing in cryptocurrencies and other high-risk assets. It also underscores the importance of transparency, accountability, and ethical conduct in the financial sector to protect investors and uphold the integrity of the banking system.

As the dust settles on this unprecedented event, the lessons learned from the cryptocurrency pig butchering scam will undoubtedly reverberate throughout the industry for years to come. The tale of greed, deception, and betrayal that played out in a small Kansas town serves as a stark reminder of the perils of chasing quick riches without considering the consequences. It is a sobering reminder that trust and integrity are the cornerstones of a resilient and trustworthy financial system, and that vigilance is key in safeguarding against fraud and exploitation.