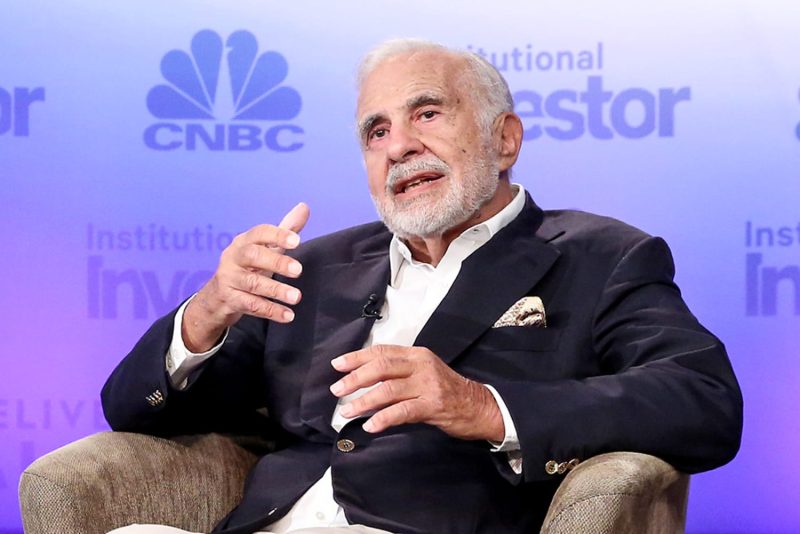

In a recent turn of events, the Securities and Exchange Commission (SEC) has filed charges against renowned billionaire investor Carl Icahn for allegedly failing to disclose stock pledges that were worth billions of dollars. This accusation has sent shockwaves through the financial industry, raising concerns about transparency and compliance with regulatory requirements.

The SEC’s investigation revealed that Carl Icahn had pledged shares of his company, Icahn Enterprises, as collateral for margin loans without disclosing these transactions to the public. These undisclosed stock pledges amounted to substantial sums, totaling billions of dollars, and were made over a period of several years.

Stock pledges are a common practice among investors, allowing them to secure loans by using their stock holdings as collateral. However, transparency and disclosure are crucial in maintaining the integrity of the financial markets. By failing to disclose these pledges, Carl Icahn may have concealed crucial information that could impact investors’ perceptions of his financial stability and the overall market.

The SEC’s allegations against Carl Icahn highlight the significance of following regulatory requirements and maintaining transparency in all financial dealings. Investors rely on accurate and timely information to make informed decisions, and any attempts to conceal relevant details can undermine the integrity of the financial system.

In response to the charges, Carl Icahn has denied any wrongdoing and expressed his willingness to cooperate with the SEC’s investigation. However, the allegations have already tarnished his reputation as a high-profile investor known for his bold and often controversial investment strategies.

As the case unfolds, it will be interesting to see how the SEC’s charges against Carl Icahn will impact his business dealings and the broader financial landscape. This incident serves as a reminder to all investors and financial professionals about the importance of complying with regulatory requirements and upholding ethical standards in their financial activities.