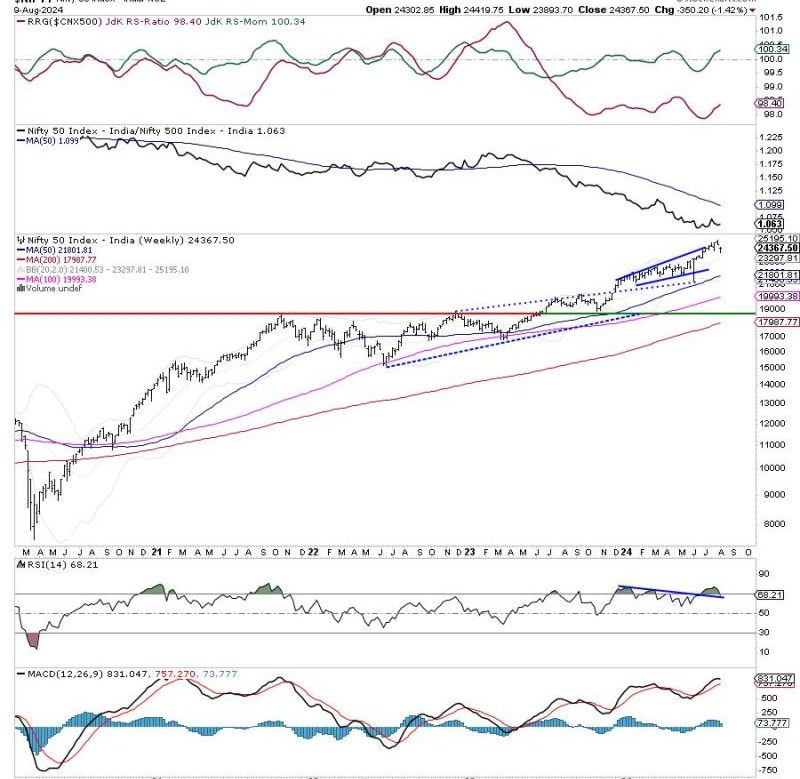

Get Ready for the Market: NIFTY Navigates Defensive Shifts! Master These Key Levels Now

The economic landscape is undergoing a significant shift as the Nifty index continues to show signs of tentativeness. Investors and traders are closely monitoring the developments within the market, particularly as a defensive setup appears to be taking shape.

Market analysts and experts are highlighting the importance of understanding key levels within the Nifty index to navigate these uncertain times effectively. By having a clear grasp of these levels, traders can make informed decisions and adjust their strategies accordingly.

One of the critical factors contributing to the current defensive setup is the prevailing market sentiment, which is being influenced by various external factors. Geopolitical tensions, global economic uncertainties, and corporate earnings reports are all playing a role in shaping investor perception and market dynamics.

As the Nifty index navigates this intricate landscape, it is crucial for market participants to stay vigilant and adapt to changing conditions swiftly. By being proactive and responsive to market developments, traders can mitigate risks and capitalize on opportunities as they arise.

Moreover, with the emergence of a defensive setup, investors may need to reassess their portfolios and risk management strategies. Diversification, hedging, and tactical asset allocation could prove to be valuable tools in navigating the current market environment and safeguarding against potential downside risks.

In conclusion, the Nifty index’s tentative demeanor and the development of a defensive setup emphasize the importance of informed decision-making and strategic planning. By staying attuned to key levels, market dynamics, and external factors, investors and traders can position themselves effectively in the ever-evolving financial landscape.