Triple Confirmation: Bearish Phase Supported by Market Sentiment Indicators

Market Sentiment Indicators: A Guide for Investors

Understanding market sentiment is crucial for investors seeking to make informed decisions. Market sentiment refers to the overall attitude or mood of market participants towards a particular asset, market, or economy. By analyzing market sentiment indicators, investors can gain insights into market trends and potential opportunities. In this article, we will explore three key market sentiment indicators that can help confirm a bearish phase in the market.

1. Investor Sentiment Surveys:

Investor sentiment surveys are tools used to gauge the opinions and attitudes of investors towards the market. These surveys typically ask respondents about their expectations regarding the direction of the market, their confidence levels, and their investment strategies. Popular surveys include the American Association of Individual Investors (AAII) Sentiment Survey and the Investors Intelligence Survey.

A high level of bullish sentiment in these surveys can indicate that investors are overly optimistic and may have already priced in positive news, leaving little room for further upside. Conversely, a significant increase in bearish sentiment can signal that investors are pessimistic about the market’s future prospects. When a bearish sentiment prevails, it may suggest that the market is due for a correction or downtrend.

2. Put/Call Ratio:

The put/call ratio is another important market sentiment indicator that measures the ratio of bearish bets (puts) to bullish bets (calls) in the options market. A high put/call ratio indicates that investors are buying more put options, which are used as insurance against market declines. This can signal a high level of fear or pessimism among investors, suggesting a potential downturn in the market.

Conversely, a low put/call ratio may indicate excessive optimism and complacency among investors, potentially signaling an overbought market. By monitoring changes in the put/call ratio, investors can gauge shifts in market sentiment and adjust their investment strategies accordingly.

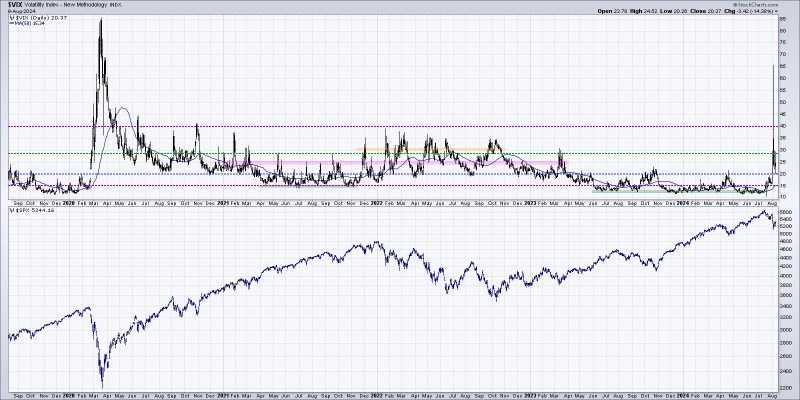

3. Volatility Index (VIX):

The Volatility Index (VIX), also known as the fear index, measures market volatility and investor expectations for future market volatility. A high VIX reading indicates that investors are anticipating increased market turbulence and uncertainty, signaling a heightened level of fear or bearish sentiment.

During periods of market stress or uncertainty, the VIX tends to spike as investors rush to purchase options as a hedge against potential losses. On the other hand, a low VIX reading may suggest that investors are complacent and optimistic about the market’s future direction. By monitoring the VIX, investors can assess the prevailing market sentiment and adjust their risk management strategies accordingly.

In conclusion, market sentiment indicators provide valuable insights into investor perceptions and attitudes towards the market. By analyzing indicators such as investor sentiment surveys, put/call ratio, and the Volatility Index, investors can better understand market trends and potential risks. While no single indicator can predict market movements with certainty, using a combination of sentiment indicators can help investors make more informed decisions and navigate market conditions effectively.