The latest market fluctuations have left many investors on edge, particularly those closely monitoring the Nasdaq Composite Index. The index, known for its heavy tech sector influence, has been experiencing significant volatility recently, prompting concerns over potential bearish trends. As investors grapple with shifting market dynamics, several critical levels have emerged that could provide key insights into the direction of the Nasdaq in the coming weeks.

One of the crucial levels to watch is the 200-day moving average (MA), which stands as a widely-followed indicator of long-term market trends. In the case of the Nasdaq, the index has been oscillating around this level, reflecting the current uncertainty and indecision among market participants. A sustained break below the 200-day MA could signal a more pronounced downward trend, potentially leading to further sell-offs across the tech-heavy index.

In addition to the 200-day MA, another important level to monitor is the support level around 12,500. This level has acted as a key pivot point in recent trading sessions, with the Nasdaq repeatedly testing its ability to hold above this critical threshold. A breach below 12,500 could trigger accelerated downside momentum, exacerbating the index’s overall bearish outlook.

Furthermore, investors should pay close attention to the Nasdaq’s relative strength index (RSI), a momentum indicator that measures the speed and change of price movements. Currently, the RSI for the Nasdaq is hovering around the 30 level, indicating oversold conditions. While this could potentially signal a near-term bounce-back in prices, investors should remain cautious, as a prolonged period of oversold conditions could further weigh on the index’s performance.

In light of these critical levels and technical indicators, market participants are advised to closely monitor the Nasdaq’s price action in the coming days. A break below key support levels and sustained bearish momentum could potentially signal a broader market correction, with significant implications for tech stocks and related sectors.

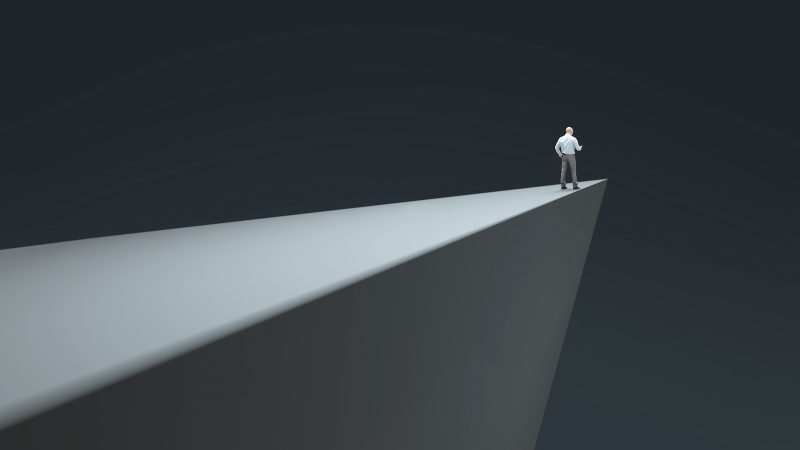

Overall, the Nasdaq’s precarious position on the edge of critical support levels underscores the fragility of current market conditions. As investors navigate through these uncertain times, a cautious approach, coupled with a keen eye on key technical levels, will be essential in managing risk and capitalizing on potential opportunities in the ever-evolving market landscape.