In the world of finance, one frequently discussed chart pattern is the double top formation. This technical analysis pattern is often considered a bearish signal, indicating a potential reversal in an uptrend. One recent market sector that has been exhibiting a double top pattern is the semiconductor industry, as evidenced by the performance of the ETF SMH.

The semiconductor industry serves as a critical component of the global economy, providing the chips and processors that power an array of devices and technologies. As such, movements in semiconductor stocks and ETFs can be closely monitored for insights into broader market trends.

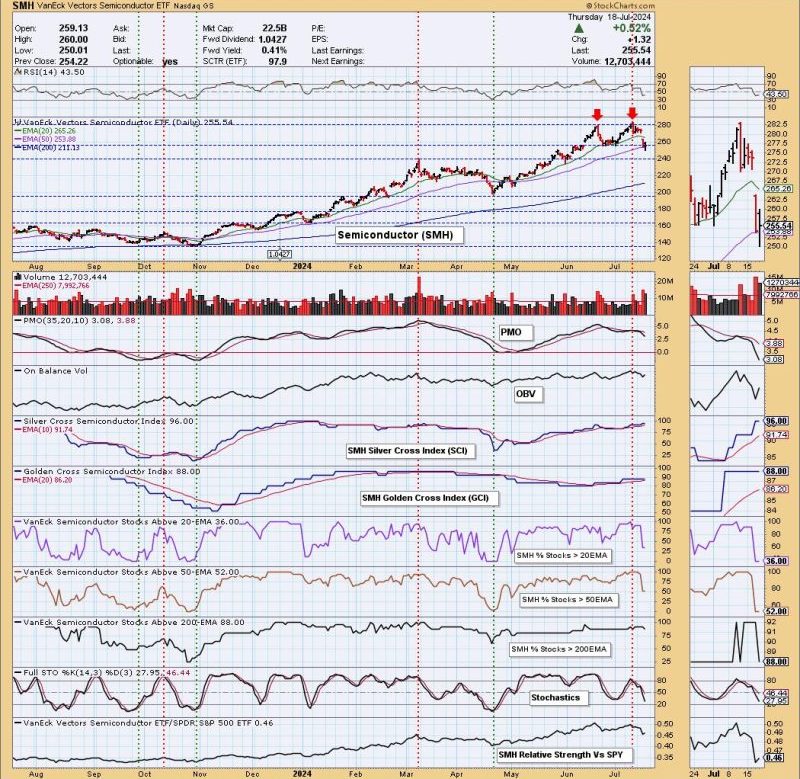

The SMH ETF, which tracks the performance of semiconductor companies, has displayed a notable double top pattern in its chart. A double top formation typically consists of two peaks at approximately the same price level, separated by a trough. The pattern suggests that buyers are becoming exhausted, leading to a potential reversal in the price trend.

In the case of SMH, the initial peak occurred at a certain price level, followed by a temporary decline before rallying to reach a second peak near the same price level. This symmetry in price action is a key characteristic of the double top pattern.

Technical analysts often look for confirmation signals to validate the double top formation. This may include a break below the neckline, which is a support level connecting the lows between the two peaks. A decisive move below the neckline can signal a bearish trend reversal, with potential downside targets based on the pattern’s measurement.

Traders and investors who are attuned to technical analysis may view the double top formation on the SMH ETF as a cautionary signal. It suggests that the semiconductor sector may face headwinds in the near term, potentially leading to a pullback in prices. Market participants may adjust their positions or consider alternative investment opportunities based on this pattern.

It is important to note that technical analysis, including chart patterns like the double top formation, is just one tool among many used in financial analysis. While these patterns can provide valuable insights into market sentiment and potential price movements, they are not guarantees of future performance.

As with any investment decision, thorough research, risk management, and a diversified portfolio approach are essential for navigating the complexities of the financial markets. By staying informed and leveraging a range of analytical tools, market participants can better position themselves to make sound investment choices in an ever-changing landscape.