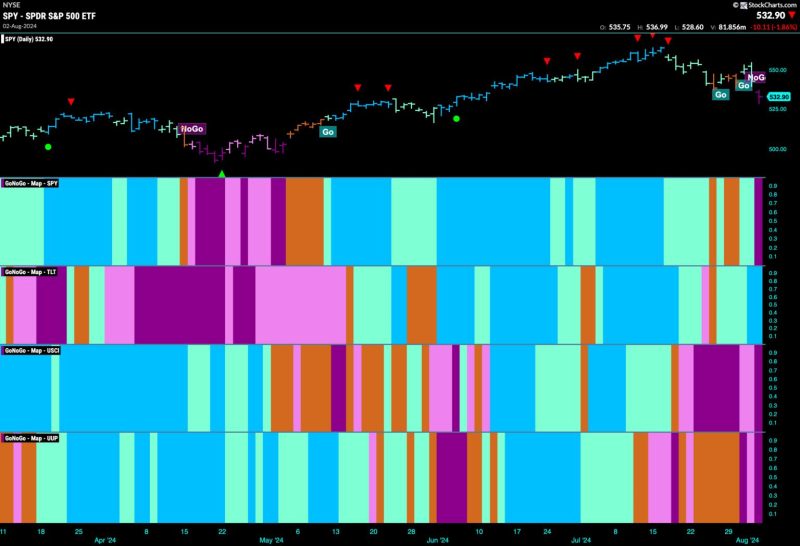

Market Index Takes a Dive: Stocks Shift to Defensive Mode in ‘NoGo’ Territory

Stocks Get Defensive as Market Index Enters ‘NoGo’ Zone

The current market sentiment has investors on edge as the market index has entered what analysts are calling the ‘NoGo’ zone. This term refers to a period where market uncertainty and volatility are high, leading investors to seek out defensive stock options to protect their portfolios from potential downturns.

The shift towards defensive stocks is evident in the recent market activity, with sectors such as utilities, consumer staples, and healthcare outperforming sectors that are more sensitive to economic fluctuations, such as technology and industrials. Investors are flocking to these defensive sectors due to their stable earnings, reliable dividends, and lower risk profiles.

One of the key reasons driving this shift towards defensive stocks is the growing concerns over the global economic outlook. Ongoing trade tensions, geopolitical uncertainties, and slowing economic growth in key markets have created a sense of unease among investors, prompting them to adopt a more cautious approach to their investment strategies.

Additionally, the recent uptick in market volatility has further fueled the demand for defensive stocks. Investors are looking to shield their portfolios from sharp market swings and potential downside risks by opting for stocks that have historically shown resilience during turbulent times.

Furthermore, the Federal Reserve’s recent interest rate cuts have also played a role in bolstering the appeal of defensive stocks. Lower interest rates make defensive sectors more attractive to investors seeking yield and stability, as these sectors often offer above-average dividends and tend to perform well in a low-interest-rate environment.

As investors navigate the ‘NoGo’ zone, it is crucial for them to carefully assess their risk tolerance and investment goals. While defensive stocks can offer protection during market downturns, they may not provide the same level of growth potential as more cyclical stocks in a bull market.

In conclusion, the current market environment has pushed investors towards defensive stocks as they seek to safeguard their portfolios against uncertainty and volatility. By understanding the key drivers behind this shift and carefully evaluating their investment choices, investors can position themselves more effectively to weather market fluctuations and achieve their long-term financial objectives.