Unlocking the Power of the 1-2-3 Reversal Pattern: A Guide to Mastering Market Trends

The 1-2-3 Reversal Pattern: A Powerful Tool for Traders

Understanding market trends and patterns is essential for traders looking to make informed decisions in the financial markets. One such pattern that has gained popularity among traders is the 1-2-3 reversal pattern. In this article, we will delve into what the 1-2-3 reversal pattern is and how traders can effectively use it to their advantage.

What is the 1-2-3 Reversal Pattern?

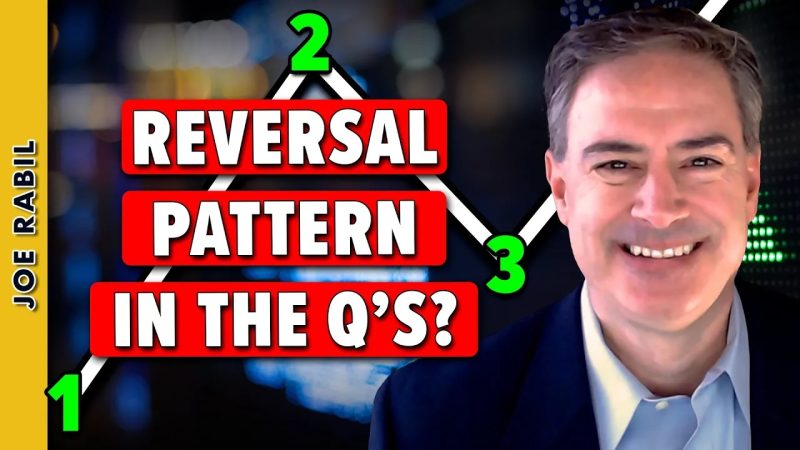

The 1-2-3 reversal pattern is a technical analysis pattern that signals a potential reversal in the direction of a prevailing trend. The pattern consists of three distinct price moves:

1. The first move is a trend in a particular direction, which could be an uptrend or a downtrend.

2. The second move is a retracement against the prevailing trend, indicating a pause in the market movement.

3. The third move is a resumption of the initial trend, confirming the reversal pattern.

The basic idea behind the 1-2-3 reversal pattern is that after the third move, the market is likely to reverse its direction, providing traders with a trading opportunity.

How to Identify and Use the 1-2-3 Reversal Pattern

Identifying the 1-2-3 reversal pattern requires a keen eye for price action and market dynamics. Here are the steps to identify and use the pattern effectively:

1. Step One: Spotting the Initial Trend

Start by identifying a clear and established trend in the market. This could be an uptrend with higher highs and higher lows or a downtrend with lower highs and lower lows.

2. Step Two: Spotting the Retracement

Once the trend is identified, look for a retracement against the trend. This retracement should be a temporary pause in the prevailing market direction.

3. Step Three: Spotting the Reversal

After the retracement, watch for a resumption of the initial trend. The market should make a move in the direction of the initial trend, confirming the reversal pattern.

4. Step Four: Entry and Exit Points

Once the 1-2-3 reversal pattern is confirmed, traders can enter a trade in the direction of the reversal. Entry points can be set at the break of the high or low of the pattern, depending on the trend direction. Stop-loss orders can be placed to manage risk, and profit targets can be set based on the potential price movement.

5. Step Five: Risk Management

As with any trading strategy, risk management is key when trading the 1-2-3 reversal pattern. Traders should set stop-loss orders to limit potential losses and use proper position sizing to protect their capital.

In conclusion, the 1-2-3 reversal pattern is a powerful tool for traders looking to identify potential trend reversals in the market. By understanding how to spot and use this pattern effectively, traders can improve their trading strategies and capitalize on profitable trading opportunities.