In today’s fast-paced financial landscape, it’s becoming increasingly apparent that the tides are shifting. Investors are starting to notice a transition in the market dynamics as financials begin to outperform and equity trends reveal signs of weakening.

The financial sector, comprising banks, insurance companies, and other financial institutions, has been showing resilience in the face of a changing economic climate. As interest rates fluctuate and global uncertainties persist, financial stocks have emerged as a standout performer, attracting interest from investors seeking stability and potential growth opportunities.

This shift can be attributed to several key factors. One of the primary drivers is the potential for higher interest rates, which typically benefit financial companies by boosting their net interest margins and profitability. With the Federal Reserve signaling a potential tightening of monetary policy in response to increasing inflationary pressures, financials are positioned to benefit from a more favorable interest rate environment.

Furthermore, the performance of the financial sector is closely linked to the overall health of the economy. As economic indicators point to a gradual recovery from the pandemic-induced downturn, financial stocks are seen as a bellwether for the broader market sentiment. Strong corporate earnings and robust economic data have contributed to the positive momentum in the financial sector, attracting both institutional and retail investors looking for exposure to sectors with growth potential.

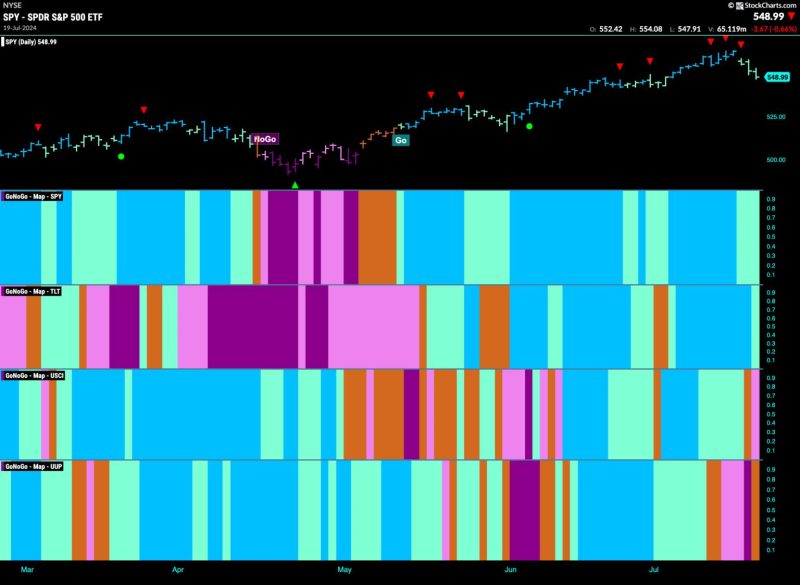

On the other hand, equity markets have been displaying signs of weakness, with some high-flying tech and growth stocks experiencing volatility and corrections. The shift in investor sentiment away from speculative growth plays towards more value-oriented investments has been a notable trend in recent months. This transition is reflected in the performance of equity indices, which have begun to show signs of fatigue after a prolonged period of gains.

Investors are now recalibrating their portfolios to navigate the evolving market conditions. Many are reallocating funds from overvalued equities to undervalued sectors such as financials, which offer a compelling risk-reward profile. Diversification strategies that incorporate a mix of asset classes, including equities, bonds, and alternatives, are gaining traction as investors seek to mitigate risks and capture opportunities in a dynamic market environment.

As financials begin to outperform and equity trends weaken, investors are advised to adopt a prudent and adaptive investment approach. Staying informed about market developments, conducting thorough research, and consulting with financial advisors can help investors make well-informed decisions that align with their financial goals and risk tolerance.

In conclusion, the shifting dynamics in the financial and equity markets offer both challenges and opportunities for investors. By staying vigilant, disciplined, and nimble, investors can navigate the changing landscape and position themselves for long-term success in an ever-evolving financial ecosystem.