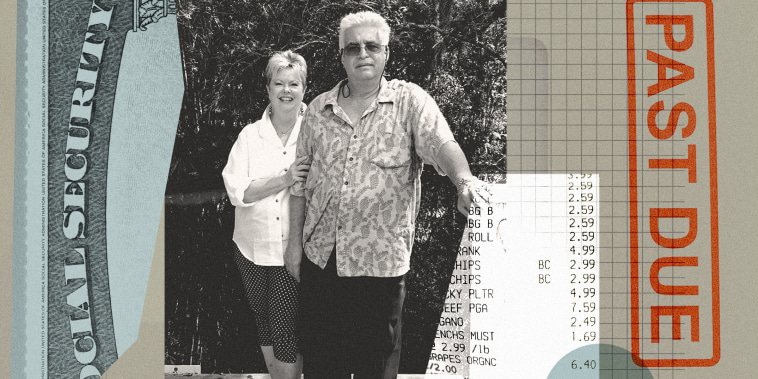

Florida Retiree Struggles to Make Ends Meet on $2,400 Monthly Income Amidst Vanishing Savings

The article you referenced outlines the financial challenges faced by a retiree in Florida who is living off $2,400 a month. The retiree, who previously had a comfortable lifestyle, found herself struggling to make ends meet due to various financial setbacks, leading to her missing out on her golden years. This story sheds light on the importance of financial planning and budgeting, especially during retirement.

One of the key takeaways from this situation is the necessity of having a robust savings plan in place before retirement. Many people underestimate the amount of savings they will need to maintain their desired lifestyle once they stop working. This oversight can result in individuals having to rely on limited resources, like Social Security benefits, as their primary source of income in retirement.

Additionally, unexpected expenses can quickly deplete savings and derail financial plans. Medical emergencies, home repairs, or other unforeseen events can put a strain on a retiree’s budget, making it challenging to cover essential expenses. It is crucial for individuals to have an emergency fund set aside to handle such situations without tapping into their retirement savings.

Furthermore, the rising cost of living can erode a retiree’s purchasing power over time. Inflation, increased healthcare costs, and fluctuating housing expenses can all impact the viability of a fixed income. Retirees must regularly reassess their budget and adjust their spending habits to accommodate these changes to avoid running out of money prematurely.

Seeking assistance from financial advisors or professionals can also be beneficial for retirees facing financial challenges. These experts can provide valuable insights, strategies, and solutions to help individuals make informed decisions about their finances and plan for a secure retirement.

In conclusion, the story of the Florida retiree living off $2,400 a month serves as a cautionary tale about the importance of proper financial planning and management during retirement. By saving diligently, preparing for unforeseen expenses, and seeking professional guidance, retirees can enhance their financial stability and enjoy their golden years without financial stress.