Bearish Storm Brewing: Markets on Edge for Action-Packed Week Ahead

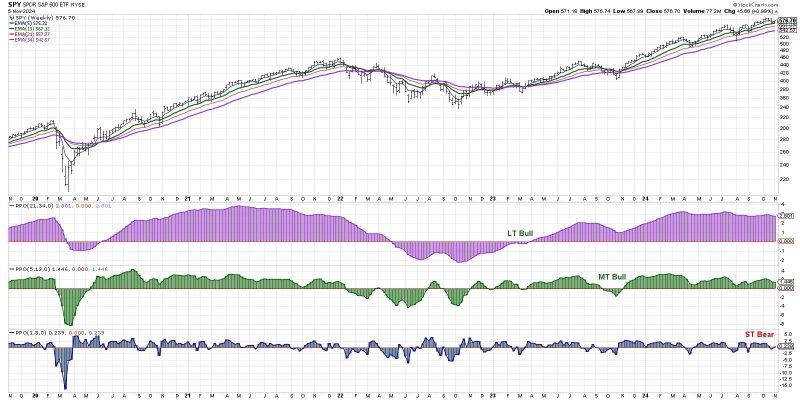

In the ever-evolving world of financial markets, the ability to interpret signals and make informed decisions is crucial for success. As we head into a news-heavy week, investors are bracing themselves for potentially significant market movements. One signal that has caught the attention of many analysts is the short-term bearish sentiment that seems to be prevalent in the markets.

Short-term bearish signals often indicate a temporary downturn in the market or a period of increased uncertainty. This can be caused by a variety of factors, such as negative economic data, geopolitical tensions, or market volatility. Investors who are able to recognize and react to these signals can position themselves to protect their investments or even profit from a downturn.

While short-term bearish signals can be concerning, they can also present opportunities for savvy investors. By staying informed and monitoring market conditions closely, investors can take advantage of potential buying opportunities when prices are low. Additionally, options and other derivatives can be used to hedge against potential losses during bearish periods.

It is important for investors to keep a balanced perspective when interpreting short-term bearish signals. While they can indicate a period of uncertainty or volatility, it is crucial not to overreact and make impulsive decisions. Instead, investors should stick to their long-term investment plans and consider the bigger picture before making any significant changes to their portfolios.

In conclusion, short-term bearish signals can serve as valuable warnings for investors, prompting them to reassess their positions and make adjustments as needed. By staying informed, maintaining a long-term perspective, and approaching market fluctuations with a level head, investors can navigate periods of uncertainty and potentially even profit from them. As we move forward into this news-heavy week, it will be essential for investors to pay close attention to the signals and be prepared to act accordingly.