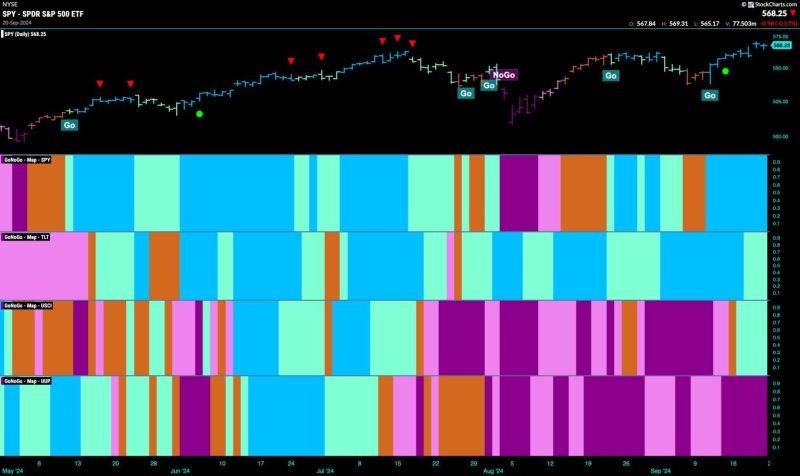

Riding the Bull: Equities on a High-Speed “Go” Trend, Fueled by Financials

Equities Remain in Strong Go Trend Powered by Financials

The global equity markets have continued their strong upward momentum in recent months, with key financial sectors playing a crucial role in driving this sustained growth. As identified by financial experts and analysts, the current market environment exhibits signs of a Go Trend, reflecting the bullish sentiment and positive expectations in the financial realm.

One of the primary drivers behind the robust performance of equities is the consistent and resilient performance of financial institutions. The financial sector, comprising banks, insurance companies, and diversified financial services, has proven to be a steady pillar supporting the broader stock market. The effective management of risks, improved profitability, and strengthening balance sheets have contributed significantly to the sector’s positive performance.

Amidst economic uncertainties and market fluctuations, financial stocks have emerged as key beneficiaries of several favorable factors. Accommodative monetary policies implemented by central banks across the globe have facilitated lower interest rates, boosting the profitability of financial institutions through reduced borrowing costs and enhanced lending activities. Additionally, the gradual economic recovery post the pandemic-induced slowdown has positively impacted the financial sector, driving investor confidence and inflows into financial stocks.

Notably, technological advancements and digital transformation have played a pivotal role in reshaping the financial landscape. The adoption of fintech solutions, digital banking services, and innovative payment platforms has enabled financial institutions to enhance their operational efficiency, customer engagement, and overall competitiveness in the market. As such, financial companies embracing digitalization have demonstrated a greater ability to adapt to changing market dynamics and deliver superior financial performance.

Furthermore, regulatory reforms and stringent risk management practices have bolstered the stability and resilience of financial institutions in a rapidly evolving market environment. Heightened regulatory scrutiny, improvements in corporate governance, and enhanced transparency have instilled greater investor confidence and trust in financial companies, underpinning their sustained growth and profitability.

Looking ahead, the outlook for equities, particularly financials, remains optimistic as the global economy continues to recover from the impacts of the pandemic. The ongoing vaccination drives, fiscal stimulus measures, and improving economic indicators are expected to support further market gains, with financial stocks poised to benefit from the favorable macroeconomic environment.

In conclusion, the prevailing Go Trend in equities, driven by the robust performance of financial sectors, underscores the resilience and positive outlook of global markets. Financial institutions, leveraging technological innovations, regulatory reforms, and supportive economic conditions, are well-positioned to navigate uncertainties and capitalize on emerging opportunities in the evolving financial landscape. As investors remain attuned to market developments and sector-specific trends, a prudent investment strategy focusing on diversified financial assets can potentially yield favorable returns in the prevailing market dynamics.